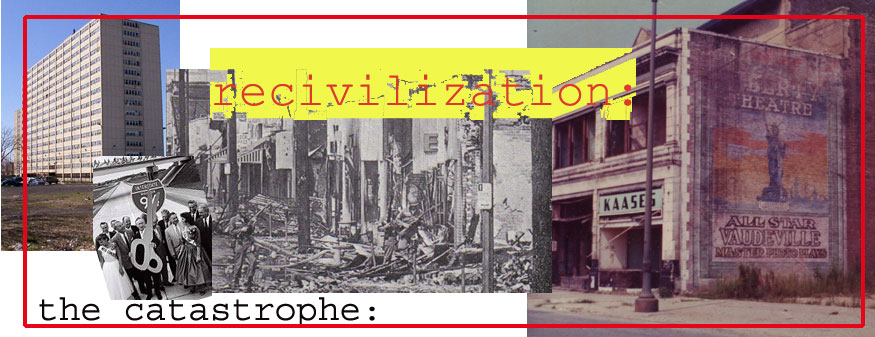

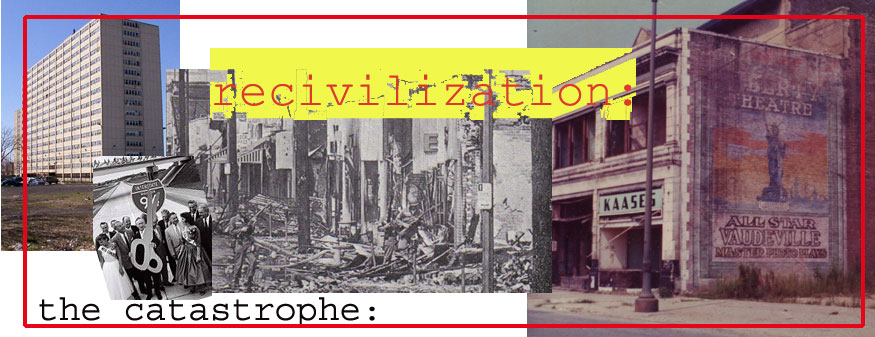

337 disinvestment1972: The Section 235 scandals splashed across the headlines shortly after the demolition of Pruitt-Igoe alerted Americans to the crisis in public housing. Not only did policymakers begin to question the thinking, or lack of it, behind the government's social and urban efforts, but the disasters were becoming increasingly apparent to people in the neighborhoods themselves. A movement against redlining started on Chicago's West Side, led by an eloquent housewife-turned-activist named Gale Cincotta. It rapidly grew nationwide, and coalesced with the founding of National People's Action in 1972. This focused and effective organization, an umbrella organization of neighborhood groups that is still fighting the good fight today, did not demand government money and new programs. Cincotta and her people had nailed the real killers of neighborhoods. 'We became empowered, and understood it was the powers that be, the banks, the Federal Reserve Board and the other regulators, the government that was the enemy. We had found the enemy and it wasn't us!' Like most useful things in America, NPA received little attention from the media, even when its marchers took over Wall Street for a day. But something unprecedented had happened. The liberal state had finally succeeded in mobilizing a serious grass-roots neighborhood movement—not in support of its urban policies, but against them. From the beginning, NPA's people identified the FHA as the number one problem in neighborhoods. The case against the agency was airtight. The founder of official redlining and stout champion of racial segregation had been strangling neighborhoods ever since it was founded. Even a few blacks moving into an area could cause the administration to bring out its red pencil and cut off credit. In the 50's. the FHA redlined entire cities, such as Camden, New Jersey, helping ensure that unfortunate community's future among the most woebegone towns in America. In general, the areas where FHA redlines were drawn most broadly show the greatest deterioration, and naturally the cities of the northeast with their large black populations suffered by far the most. Despite their illegality, FHA officials were still maintaining unwritten restrictive covenants and traditions of segregation as late as 1968. In truth, for all its villainy, the FHA served the activists mostly as a relatively easy target; it was commonly believed at the time that a government has a conscience, while banks and businesses do not. But since its inception, the FHA had only served to rationalize and formalize policies that were already widespread. In the 70's, neighborhood groups, national advocacy organizations and sympathetic minds in the universities refined the concept of disinvestment , to highlight the broader phenomenon that was condemning once-stable neighborhoods to wither and die. Over the decades, the U. S. has set up the legal framework for a market that is unequalled for generating housing and new communities, but perversely enough, one that literally devours older neighborhoods, while it exploits the poor and minorities and makes a mockery of their aspirations for first-class citizenship. We can think of government-sponsored disinvestment as taking two separate but complementary forms, one directed against minorities and the other against older neighborhoods. The latter is usually imposed in terms of age of structures in an area, its lot or building sizes, or building conditions. Lenders always prejudice any kind of non-homogenous neighborhood, one that is racially mixed, or shows mixed land use, or even one that contains a mixture of single-family homes and apartments. The Depression phenomenon of falling city real estate values, a shock to that generation, combined with the 'ring theory' developed by the Chicago School of sociologists to cause a panic in financiers' perceptions. Inner-city land now seemed condemned to a relentless decline. The new theory, true only when the feds intervened with freeways or urban renewal, or when lenders made it a self-fulfilling prophecy, determined that values in downtown fringes must always necessarily fall. Residents and local businessmen in the old neighborhoods soon learned the consequences of this theory's application. To potential customers, the new 'redlining' could take the form of outright refusal of a loan, or the more devious route of offering impossibly high down payments or interest rates. All through the postwar era, the only place blacks found home ownership made easy for them was in places where lenders were colluding in the panicking-out of a neighborhood. Then, lower down payments and better rates would magically become available. Yet for most blacks and poor whites, the premiums they had to pay for houses and mortgages left them with little cash for repairs and maintenance, contributing to decay and increasing the likelihood of default. The situation would improve after the neighborhood movement pushed through the landmark Community Reinvestment Act in 1977, but even in the 80's, white census tracts in New York were found to be getting seven times as many mortgage loans as black ones, three times as many as black ones of comparable income. Even though bank and savings-and-loan charters required them to serve their communities, in the postwar era it was nearly always a case of inner-city customers seeing their deposits invested in new construction in the suburbs; inner-city branches took deposits but refused loans, or simply closed. By a parallel process, northeast and midwest money was taken out of the region to finance the growth of the sunbelt. The concept of disinvestment broadened again as neighborhood groups noticed that insurance companies' practices mirrored those of the banks. Even when mortgage money was available, blacks and other inner-city residents often found that no one would write a home insurance policy for them, which lenders always require. Disinvestment is a progressive operation; the last stage comes when homeowners simply walk away, when apartment owners give up on maintaining buildings for the long term, and squeeze the last bit of profit out of them before abandonment. Federal programs inadvertently assist them, and they still do. Owners can make quick profits from rent-support programs, as they gradually cut down on maintenance. Federal rules for keeping up buildings involved in their programs do not work. The Section 235 and 236 programs established the ground rules for making HUD a cesspool of incompetence and corruption, and while the programs change, highjinks involving local HUD offices and property management companies continues to be widespread today. When the building reaches an uninhabitable state, the owner empties it and strips all the fittings, and then, if he thinks he can get away with it, he might torch it for the insurance. This is what happened to the South Bronx, which suffered 40,000 arson fires in the 70's, and it was repeated on a smaller scale in every city in the land. The stereotypical slum landlord who did not burn down his properties, a stock character of the local news in the 60's and 70's, was commonly a verbose, exasperating old lawyer who owned a lot of elegant-but-doomed apartment properties. This crusty old scoundrel was usually semi-retired, which gave him all the leisure in the world to dream up new ways to tie the courts in knots whenever a housing or health inspector dared lay a case against him. When the cameras were on him, he would launch into his canned diatribe against rent control, high taxes and intrusive bureaucracies. And the mayor: he's a fink too. I could honor some of these gentlemen by name, but if by chance they are still alive they would probably sue me. Leave aside, for a minute, the fact that the old slumlord's analysis of the urban situation often proved more insightful than anything coming out of the universities and think tanks. He represented a part of the bourgeoisie that had got severely frazzled by the urban catastrophe. Petty landlords became victims of hurricane changes that often made them feel as threatened and confused as their tenants, who had come a long way from the South only to find they suddenly had no work and no friends. These landlords, often enough, were the inheritors of a modest family interest that had taken maybe three or four generations to build up. And often they were immigrant families, ones that had made the fatal mistake of investing in their own neighborhoods. No one, in this era, was listening to them, and their histrionics can be taken as a kind of urban folk art, a desperate attempt to gain some attention. They had reason to be a little crazy. In the 1970's, in areas like the South Bronx and Brooklyn, landlords were walking away from properties valued in the hundreds of thousands of dollars. Something had gone very wrong. To the tenant's rights organizations and aspiring politicians, the slum landlord was the fellow with the black mustache who liked to tie Little Nell to the railroad tracks, and they organized picketing and rent strikes against him. To the ascendant left, he provided a symbol of everything that was wrong with capitalism. To the right, he was just a schmuck who did not have the sense to get out in time. And here lies the twist in the tale. The petty landlords were not the only fish in the pond, merely the smallest, weakest and slowest to react. Much more of the property, in the 'uptown' districts and threatened middle-class neighborhoods, had been in the hands of downtown banks, insurance companies, finance companies and a few big family trusts. When the FHA institutionalized redlining, it said in effect that the government was betting against older neighborhoods, and the big money followed its accustomed herd instinct and bailed out, quickly and quietly. The new owners would be the underfinanced and sincere, or else speculating sharks, of the sort that in the 60's would learn the game of milking a building and then torching it or letting it get foreclosed for taxes. When big capital walked away from inner-city areas, the smaller landowners were left alone to take the big losses. The interests most removed from and indifferent to neighborhood concerns generally prospered during the Catastrophe. The small operators committed to their neighborhoods suffered in proportion to their loyalty. |

|

|